Let’s face it, all around the world our wallets are experiencing the pinch of inflation with rising costs for nearly everything. That is indeed the case in Costa Rica where I see my grocery bills up 25%, my rental rates are increasing, and pain at the pump. Retirement planners emphasize that you need to account for inflation when evaluating your nest egg. That being said, when we moved to Costa Rica 8.5 years ago, a number of new tax obligations and fees that have recently been introduced did not exist whatsoever.

This does introduce a layer of bureaucracy into owning in Costa Rica that wasn’t there before. It’s going to raise investors’ taxes a little. The holding costs are still likely to be less than you’d pay in the States. But it is a change, and we want to make sure you know it’s coming down the pike if Costa Rica is on your shortlist.

Corporation Tax or Impuesto al las Personas Juridicas

Most expats in Costa Rica keep their major assets like a home, car, or bank account in a “corporation.” The typical ones are the Limited Liability Company (Sociedad de Responsibilidad Limitada or SRL) or the Sociedad Anonima (S.A.). These were created because the owners could remain entirely anonymous and protect their Costa Rican assets from liability and foreign taxes. Plus, if you are not a legal resident yet, it will be much easier to open a bank account and turn on your utilities with a corporation. There is an initial cost for your attorney to create it ($1,000 to $1,400) and then its job is to “inactively” hold your asset.

Even before we moved to Costa Rica, we set up a corporation whilst on a scouting trip—in anticipation of one day purchasing property (they were half the price back then). It cost us nothing but the initial set up and it sat for years waiting. Well, times have changed and now the government not only taxes “active” corporations (those that actively do business), but also inactive ones. The tax increases slightly each year and is due annually at the end of January. 2022’s tax was ¢69,330, approximately US$109 per inactive corporation.

Luxury Home Tax or Impuesto Solidario para el Fortalecimiento de Programas de Vivienda (Law # 8683)

This tax targets luxury homeowners—no, I am not talking just multi-million-dollar estates. The tax is based on the construction value of the home, but the threshold continually lowers each year. It may be “luxury” for some, but for most foreigners buying property, it would be nothing like a value you may think of back home. For 2022, all homes with a construction value over ¢133.000.000,00 (US$211,783 approx.) are required to pay this tax.

Construction value or “project value” means the total costs to the owner for the construction in its completed form and includes the cost of design, all building work, construction materials, building systems, and profit of the contractor and subcontractors, but does not include the cost of non-fixed furnishings or non-fixed equipment. This is different than the market value.

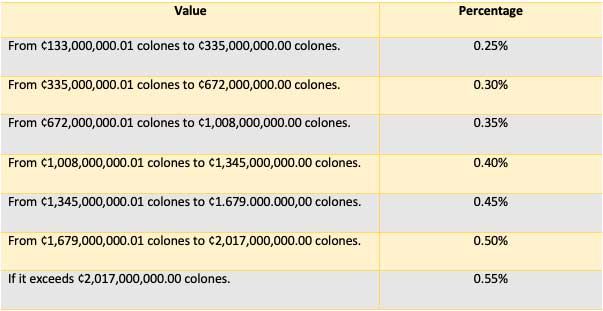

Taxpayers must enroll with the Tax Administration, then declare and pay the tax through the Virtual Tax Administration (ATV) site. Every three years the homeowners require an appraisal from an expert in luxury home tax calculations in order to update the value. The tax is based on a sliding scale:

Capital Gains Tax

Costa Rica didn’t have a capital gains tax (except for developers) until 2019. The capital gains charge is 15% for residential properties and 30% for commercial properties. This amount is calculated off the sales profit made over your original purchase price. You are exempt if you are selling your primary residence, but you do have to prove you lived in it for 183 days or more each year. If you have a titled property purchased prior to July 1, 2019, you have the one-time option of paying a flat 2.25% of the sale price rather than the capital gain.

Restaurants, stores, hotels, and vacation rentals are categorized as commercial real estate. Basically, anything that is income producing, and therefore taxed at 30%. This is something to keep in mind if you are buying a vacation rental condo/home. It is best to talk to your Costa Rican CPA or lawyer to be clear regarding the income-generating asset and your income tax obligations with a vacation rental property.

Get Your Free Costa Rica Report Here:

Learn more about Costa Rica and other countries in our daily postcard e-letter. Simply enter your email address below and we'll send you a FREE REPORT – Costa Rica: The Land of Pura Vida

This special guide covers real estate, retirement and more in Costa Rica and is yours free when you sign up for our IL postcards below.

The Mandatory Declaration of Beneficial Owners and Shareholders

All registered corporations (active and inactive) now need to annually declare their “shareholders”—making that once anonymous corporation completely transparent. The government has added this law in their efforts to thwart money laundering from drug dealers and other illegal practices.

For the honest folks, this is not a big deal. Until it is. Many investors here keep their assets in an inactive corporation, but they may not be legal residents. Therefore, they do not have a DIMEX cedula (foreign resident ID). If you don’t have your residency you cannot apply for a digital signature (firma digital) card. If you do not have a digital signature card you cannot file the form on your own. So, it will be necessary to pay a lawyer with power of attorney to make the declaration for you. EVERY YEAR.

High fines apply for non-compliance, from approximately US$2,300 up to US$76,000. The government is actively pursuing the application of these fines and lists of non-compliant companies have been made public, as a “last call” warning from the government on the Tax Administration website. The 2022 deadline is April 15.

D-101 Income Tax Declaración Jurada del Impuesto sobre la Renta

Unless expat retirees are generating an income in Costa Rica, the vast majority of them (and the digital nomads) do not file a Costa Rican income tax return. That is because the tax obligations are paid in your home country. However, if you own an inactive corporation, that is about to change. The government wants to now collect information regarding all the assets that inactive companies are holding. One can speculate—for a new future tax?

All Costa Rican companies will be obligated to file an Income Tax Return D-101 simplified form is typically due March 15. The deadline for 2022 has been extended to June 15.

If you are not a legal resident and want to file yourself, you will need to request a NITE number from the Ministry of Hacienda (treasury). Otherwise, you will have to pay an accountant every year to file this simple form.

Education & Culture tax

Inactive companies previously were not required to pay the education and culture tax, but now, since every company will need to file an income tax return, inactive companies will also be required to pay this assessment. It is calculated based on the net capital of a company, as follows:

- Up to 500,000 colons (US$778.84) — 750 colons tax (US$1.17)

- Over 500,000 but less than 2,000,000 (US$3,115.35) — 6,000 colons tax (US$9.35)

- Over 2,000,000 but less than 4,000,000 ($US6230.70) — 12,000 colons tax (US$18.69)

- Over 4,000,000 colons ($US6230.70) — 18,000 colons tax (US$28.04)

Basically, if your corporation holds your home or car, you are paying the top of the scale. Granted it is not a large tax, but nonetheless it is a new one to keep up with.

VAT Tax or Impuesto de Valor Agregado (IVA)

Costa Rica has long had a sales tax of 13% on all receipts for goods. However, the VAT now applies for all services rendered in the country. Every legal service has a VAT tax. From your accountant to your attorney and your dentist to your realtor. The government taxes them 13% – so you will see that passed on to the client—YOU! Some businesses accept payments in cash to avoid this reporting and save you money.

There is a way to avoid a number of these aforementioned inactive corporate obligations. You can choose to put your assets directly in your name, or dissolve the current corporation you have. In fact, many expats have recently paid the high prices to dissolve their corporations (your corporation has to sell the assets to you, so you will be paying some hefty sales taxes, as well as the cost to dissolve it). The choice is something you should discuss with your Costa Rican attorney. There are still good reasons to have a corporation and good reasons not to.

With all these new-ish taxes, am I insinuating Costa Rica is no longer a good choice for expats? No. Absolutely not. Costa Rica ranks #2 on International Living’s Retirement Index. You must factor in the incredible weather, the astounding nature, the solid healthcare that has not broken during a pandemic, the ease of fitting in, the healthy lifestyles, and all the other reasons Costa Rica ranks as one of the happiest places on earth. You just need to budget accordingly.

Get Your Free Costa Rica Report Here:

Learn more about Costa Rica and other countries in our daily postcard e-letter. Simply enter your email address below and we'll send you a FREE REPORT – Costa Rica: The Land of Pura Vida

This special guide covers real estate, retirement and more in Costa Rica and is yours free when you sign up for our IL postcards below.

Related Articles

Best Places to Live in Costa Rica: Five Top Expat Havens

An Overview of Traditions and Culture in Costa Rica

In Photos: The Top 5 Beaches in Costa Rica

Upcoming Conferences

The Only 2024 Fast Track Panama Conference

If your dream retirement involves stunning beaches… lush green mountains… a warm climate with no hurricanes… first-rate healthcare… incredible value for money (a couple can live well on $2,200 a month)… and the World’s #1 Retiree Discount Program…

Join our Panama experts and expats in February and discover why Panama could be your perfect paradise.

REGISTER NOW, SEATS LIMITED: EARLY BIRD DISCOUNT HERE

.png)