If you’re of retirement age and you’ve decided to retire overseas, lucky you. And smart you. Not only are you about to embark on an adventure of a lifetime, but you’ve likely made a very wise decision. Because almost anywhere you might settle will surely cost less than living in the U.S. these days.

But if you’re wondering if you can really live on a small income overseas, the answer is yes. If you are a retiree living on the average Social Security income, which is $1,369 in 2017, you can live happily and comfortably overseas.

There are many affordable locations around the world that fit the bill for expats when it comes to looking for the perfect retirement haven. In these places, you’ll enjoy a relaxed lifestyle, established expat communities, friendly, welcoming natives, good healthcare, and an ideal climate.

From Layoffs to a Laidback, Affordable Retirement in Nicaragua

Dolly Lee was a single parent raising a daughter in the U.S. and working in logistics management. For close to two decades she endured layoff after layoff…each time she built up savings, the next layoff would deplete them.

“In May 2016, I suffered another layoff and after being at home for a few weeks, I realized that I was now eligible to collect Social Security at a reduced rate,” Dolly says. Her Social Security check would not be adequate to pay her bills and the private medical insurance she’d need to purchase. “So, I started looking into the best places to retire on a budget. The only affordable options in the U.S. were in cold areas of the country with small populations. This was not for me.”

When Dolly looked overseas, she discovered the city of León in Nicaragua was for her and after some research she made it her home. Dolly says, “So far it is the best move I have ever made. My budget with housekeeper, rent, utilities, groceries, internet, cable TV, phone, and food for three animals is about $1,000 a month.

“I have a housekeeper and the amount I pay ($55 monthly) won’t break anyone’s budget. I am able to pay all of my bills, eliminate my debt, and save as well as travel as much as I want. I live in a one-bedroom, fully furnished apartment in what is considered the best neighborhood in León, with hot water and air conditioning, for $450 monthly.

“Moving to León has not only saved my life financially but enriched me so much. I am in a warm, welcoming culture surrounded by both Nicas and expats that are friendly, helpful, inviting, and caring.”

Nicaragua isn’t the only place overseas where expats are finding their Social Security dollars stretch further.

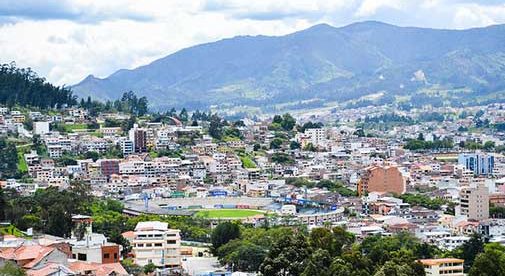

Enjoying Retirement, Not Just Surviving it, in Ecuador

Bartley D’Alfonso was living in California when he retired…he had an expensive condo mortgage to pay for, along with excessive property taxes and increasing monthly homeowners’ association fees.

“Month by month, it was becoming harder and harder to live only on my fixed Social Security benefits and retirement pension,” he says. “I was feeling trapped, with high anxiety—how was I ever going to continue to live like this? How could I survive? Something had to change, for the better, and needed to do so quickly.

“Then I remembered hearing and reading about how other North Americans faced similar dilemmas and moved overseas to other countries, where retirees could live in comfort and safety while stretching their thin finances. With a little research online and from books borrowed at the library, it became apparent that one could indeed succeed in leaving financial anxieties back home.”

After attending an International Living event, Bartley discovered the city in Ecuador that’s a firm favorite with expats…Cuenca. After visiting the city, Bartley went home, sold his condo and bought a newly built condo in Cuenca. “My three-bedroom, three-bathroom, two-story condo (at 1,500 square feet) cost $115,500,” Bartley says, “and get this—my annual property tax this year was $44…compared to $4,800 annual property taxes back home.”

As well as finding affordable real estate, Bartley also discovered that Ecuador offered abundant and cheap fresh food, a welcoming expat community, and a healthcare system that didn’t cause patients to fall into bankruptcy.

“One time, I went to a private hospital and had an MRI scan, costing $250 out of pocket,” says Bartley. “The neurologist charged me $35 for the initial exam and the follow-up appointment was free, which is normal with the doctors here.”

So does Bartley think he made the right decision to retire to Ecuador three years ago? “You bet,” he says. “I no longer feel anxious and worried when I review my finances. It is very comforting to know that I can now occupy my mind with what fun activities I will do daily, rather than how I would try to survive day-by-day if I had stayed back in the U.S.”

The Good Life on Social Security in Mexico

Mexico has long been attracting expats over the border due to its miles of pristine coastline, a vibrant and colorful culture…and the affordable cost of living. And with a favorable peso/U.S. dollar exchange rate, many expats are finding their Social Security is stretching ever farther today.

After rewarding but long careers in the U.S., Chris and Rex McCaskill (who were self-confessed workaholics) were ready to retire. They chose San Miguel de Allende, a charming town in Mexico’s Colonial Highlands, moving down permanently five years ago.

A lower cost of living was one motivation for retiring in Mexico.

“In Austin, we were paying $700 a month for heat and air conditioning. We were paying property taxes of $12,000 a year and now live comfortably with taxes of $200 a year,” says Chris. “Here in San Miguel, economics and lifestyle go hand in hand. We spend money on quality of life things, not air conditioning or taxes. We can take our money from Social Security and our quality of life is pretty darn good.”

They’ve quickly fit into the San Miguel scene and have an active social life, with friends from all sorts of backgrounds and walks of life.

“We have a huge social community here,” says Rex. “Some people have multi-million dollar homes; others are living on Social Security and in apartments for $400 a month. But we all have so much in common, like an interest in culture. We’re happy to be part of it. I thought I was going to have all kinds of time when I retired. But I don’t. We go out. We walk the dogs. We have a huge circle of friends.”

“I Live in Colombia For 60% Less Than I Did Back in the U.S.”

Most people hear “Colombia” and think cocaine kingpins and drug cartels. But that reputation is seriously out of date. Colombia is fast being discovered as the hottest new destination in Latin America.

Today, you will find a sophisticated country with cosmopolitan cities, stunning coastline, friendly locals…and an affordable cost of living.

According to International Living Colombia Correspondent Nancy Kiernan, if you plan on moving to Colombia, you can “count on spending at least $1,300 a month for two people if you own your property; and $2,200 per month if you’re renting an apartment.

Nancy says of her and her husband Mike’s move to the cosmopolitan city of Medellin, “The cost of living in the States was getting out of hand. Neither one of us wanted to belong to the “work-until-you-drop club.” We wanted to be able to enjoy life while we were still young and healthy enough.

“We bought our apartment with the proceeds from the sale of our home in Maine, and now live very comfortably on $2,000 per month. This low budget lets us spend discretionary money on travel. The idea of the once-a-year vacation…is a thing of the past. I live in Medellin for 60% less than I did back in Maine.”

Holly Holder-Sanchez lives in the university city of Popayan, about 350 miles south of the capital of Bogota. “I believe that where we retire should be a matter of choice, not simply surviving in whichever place destiny has planted us. Popayan is my retirement choice,” Holly says.

The city boasts remarkable colonial architecture. All of the buildings in the historic district are painted white, by law…thus earning it the nickname “the White City.”

“One of the many reasons I love living here is Popayan’s affordability,” says Holly. “I rent a large, tranquil house in a forest just outside the downtown district for $500 a month. I know that a similar house in the U.S. would cost three to four times as much.

“On average, my electric bills are about $18 a month, water is $13, and internet about $15 a month. Fresh veggies and tropical fruit are available all year long at open-air markets, at amazingly low prices. Tasty, dark green avocados are three for 75 cents. There are lots of restaurants at reasonable prices, my favorite being Carpe Diem, housed in one of Popayan’s lovely, oversized, 200-year-old homes. The lunches are a joy to the palate, and they cost about $3.”

Exotic and Affordable Southeast Asia

Southeast Asia is another region that offers great value for money and a place where your retirement dollars will stretch further than they will in the U.S. Thailand, Malaysia, Vietnam, and Cambodia are just some of the countries that have been enticing expats and retirees from around the globe, offering a low cost of living, picture-perfect white-sand beaches, friendly locals and fascinating culture.

Aileen and Bob Young have been in their Southeast Asia beachside retirement haven since 2013. Bob says, “We found a place that both of us like and that fits with our budget.” They live happily in a condo near the beach on Bob’s Social Security income of $1,992 a month.

In mid-2012, Bob was laid off from his job in Minnesota. He was nearly 66 years old and could not find another job at his age. That year, Aileen asked Bob to take a trip to Southeast Asia. They flew to Thailand and Cambodia in December to get away from miserable winter, freezing rain, and snow. Both came back from their trip at the end of January 2013 and decided to move to Hua-Hin, Thailand that October.

Hua-Hin is about two-and-a-half hours’ car journey from Bangkok. Aileen says, “The weather is just perfect: warm and never gets cold.”

The couple pay about $470 a month for their two-bedroom condo. Of their day-to-day meal costs, they spend less than $10 for their meals. “Food is fabulous and costs about 75% less than what we were paying in the States. If you want a meal in a luxury restaurant, you can get it for $20 or less,” says Bob.

Another source of savings and comfort is healthcare. “The quality of healthcare service here is better and less expensive than the States,” Bob says. “With doctors’ visits costing $15 on average, you can talk with doctors and nurses as long as you want, and get a prescription without additional fees.”

Bob’s Social Security check is more than enough for the couple to live well and enjoy life. “Life is too short so if you are not taking steps today to enjoy where you want to be someday—you won’t get there,” says Bob.

Expats have been attracted to Cambodia by the country’s exotic charms as well as by its fantastically low cost of living…and they are living comfortably on their Social Security. And though many came to the country due to its affordability, they have stayed because of the warm culture of hospitality among the local people.

San Diego-native Tom Richter lives in the Cambodian capital of Phnom Penh. “This country has made me feel 15 years younger, compared with living in the States,” says Tom. “I made the right decision coming here, and I know it.

“My check from Social Security comes to just over $1,000 per month. But in Phnom Penh that’s a sizable amount. What I like most is that there is a very local vibe that comes from people in Phnom Penh.

“Apart from being extremely friendly and happy to meet foreigners, it is just really cool to be able to go to the street corner in the morning to grab a fresh coconut and a newspaper, while shooting the breeze with some of the tuk-tuk drivers who speak good English.”

3 Ways to Collect Your Social Security Anywhere in the World

By Suzan Haskins

Thinking about retiring overseas and wondering how you’ll collect any federal benefits owed to you?

Rest easy, because no matter if you are a citizen of or have legally worked in the U.S. or Canada, you are entitled to your benefits no matter where in the world you choose to live.

So forge ahead with those plans to retire to the coast of Costa Rica or Panama…a little hideaway in Italy…or to whatever comfortable, welcoming place appeals to you.

There are a couple of ways you can go about collecting your Social Security once you move overseas.

Option 1: Open a local bank account in the community of your choice and have your benefits direct-deposited into that account, just as you are likely doing where you live now. You will need a resident visa in the new country to do this.

This means you will need to be fairly certain this is the place you want to retire and that you will be spending time here for the near future. (No, you are not giving up your U.S. or Canadian citizenship and this does not mean you are applying for citizenship in the new country. You are simply seeking official resident status.)

The drawback is that only certain foreign banks are qualified to accept these direct deposits of U.S. or Canada government benefits, so you’ll want to be sure the local bank you choose is eligible.

Option 2: Continue to have your benefits direct-deposited into your local bank account as you are likely doing right now. Then you can either transfer those funds to any new local bank account that you might open in your new overseas community and/or you can access your funds anywhere in the world via your debit/ATM card.

Here’s the catch: You could end up paying hefty foreign ATM surcharge fees. So be sure you know what your bank’s policies are in this regard. If their policy is not to refund those charges, it may be time to move to a bank that does.

Option 3: If you are from the U.S. and you see no need to maintain a U.S. bank account (although if you have associated credit cards, you will want one) here’s another option:

MasterCard’s Direct Express card may make sense if you’re not sure yet where in the world you might want to retire and you want to travel for a few months to check out a few different places. You don’t need any bank account or credit union account or any financial institution account at all, no credit check is required, and there are no sign-up fees, monthly account fees, or minimum balance requirement. Once you enroll, your federal benefits will be automatically deposited to your card account on your payment date.

Your funds will be immediately accessible and you can use your card to make purchases at places that accept Debit MasterCard, to pay your bills online or over the phone, and to withdraw cash from banks and ATMs anywhere in the world.

The downside is that, while you are allowed one free ATM cash withdrawal each month, your free withdrawal can only be in the U.S. (Always a catch.)

In other words, while the card can be extremely convenient if you want to cut ties with U.S. banks, you could end up paying quite a bit each month in surcharge fees.

But it’s always good to have options. And it’s definitely a good idea to understand what the benefits and drawbacks of those options are.

With today’s technological benefits, the world really is your oyster. All you need to do is find the place in it that most appeals to you…and make that place your home. With a few insider tips like these, it’s easy enough to make that happen.

How to Retire Early With More Social Security Benefits

By Steve Garfink*

When I speak to groups on Social Security claiming strategies I like to make it clear that my goal isn’t to help them wring every possible penny out of their potential benefits (though that’s okay if it happens). Rather, my intent is to provide insights into how to put our benefits to work for us to provide a dream retirement—often sooner instead of later.

It’s true that for most of us the best strategy for maximizing our cumulative lifetime benefits—all else being equal—is to wait to claim them at the age where we collect the greatest benefit amount, age 70 for a work-based claim. This usually results in tens of thousands of dollars more in lifetime benefits for a single person and commonly well over $100,000 for married couples if we simply live to our average life expectancies.

The problem with this “rule” is that “all else” isn’t always equal; in fact, it rarely is. I can make a strong case that we are better off waiting to claim our benefits if other funds are available to support us in the meantime. However, sufficient funds are not always there in our savings. As a result, if we want to retire or start a dream life overseas sooner rather than later, there are several circumstances in which we may want to start benefits earlier in order to live that dream.

Let’s look at an example of how to find a smart claiming strategy that delivers our dream sooner, while still locking in higher benefits to serve us for the duration of our retirement.

Consider Ray and Rhonda, who are both 60. They have jobs that basically cover their living expenses. There is no desire to work any longer at these careers: true, working longer will delay any need to dip into their savings of $125,000 and avoid starting Social Security early—if they work past age 62, a dreary and disheartening thought. At 66 Ray’s Social Security benefit will be around $2,320; Rhonda’s will be $1,933. What to do?

Clearly, they could live off their savings for two years then start their Social Security benefits at 62 at a reduced combined rate of $3,490 per month (reduced because they claim before their Full Retirement Ages). If you have been following International Living for any amount of time, you are aware that almost all the overseas retirement locations covered offer comfortable (even luxurious) living at well under this income. They should even be able to save some.

However, there is a far better option when it comes to their long-term financial security. Rhonda could claim her benefit at 62 in the amount of $1,450 a month. If they live on a budget of around $2,000 per month during those years—more than adequate for an excellent standard of living in many locations—they can wait to tap Ray’s benefit until he is 70, in the amount of $3,072. Thereafter they will loosen the purse strings and spend at a rate of $3,000 per month, a generous budget.

Their monthly income is $4,522 thereafter. That affords them plenty of room to replenish their savings and live at a very high standard almost anywhere they are. In fact, if they each live to their average life expectancies, they will be over $91,000 ahead compared to the both-claim-at-62 strategy (assuming identical spending under either scenario). Not a bad bonus for living the exact same lifestyle.

If they live beyond their average expectancy the extra savings continue to pile up at the rate of just over $12,000 a year thereafter. In addition, they lock in a survivor benefit of $3,072, over 76% greater than the claim-at-62 strategy.

This is just one specific illustration. Everyone has their own set of circumstances and there is no way to begin to cover them all here. The lesson we should take away from this example is to learn how the Social Security rules will apply to our particular circumstances so we can develop a custom plan that will best serve us throughout our lifetimes—and better still, permit us to make that move sooner rather than later with full confidence in locking in financial security throughout the remainder of our lives

How to Get the Most From Your Social Security

Most people know very little about their Social Security benefits…and it means they miss out on money they’re owed by not claiming their maximum benefit.

In fact, Motley Fool estimates that if every U.S. citizen knew how to claim their maximum benefit, the government would have to pay an extra $10 billion in benefits every year. That’s a lot of money being left on the table because the Social Security system is so complex and hard to navigate.

So what do you do to make sure you’re getting everything due to you in retirement from a lifetime of hard work? You learn from an expert.

Despite what you may think, that’s not the folks sitting behind desks in the Social Security offices. They’re good, hard-working people but they’re not experts…merely employees. They don’t know every trick to use and trap to avoid. With a system this complicated, how could they?

You need somebody who’s spent over 10 years digging deep into the web of rules and regulations that makes up Social Security. Someone who has made it his mission to demystify this essential system and explain it in simple terms that you can easily understand and make use of.

That man is Steve Garfink and in the video below he explains how to get the best from your Social Security.

*Editor’s note: Steve Garfink has 34 years of experience in finance, strategic planning, and general management. In that time, Steve has honed his ability to present complex financial concepts to the general public clearly and effectively. Currently, he focuses these skills on educating the American public on how to get the most out of their Social Security benefits. Steve is the author of Retire in Luxury on Your Social Security.

Get Your Free Report on the World’s Best Places to Retire:

Learn more about the best places in the world to retire in our daily postcard e-letter.

Simply enter your email address below to sign up for our free daily postcards and we’ll also send you a FREE report on The World’s Top 10 Retirement Havens, plus access to over 10 more free reports. Our gift to you, on our favorite destinations.

Related Articles

Can I still Claim My Social Security if I move to Mexico

Beach Hopping Down Costa Rica’s Coast on My Social Security

Can we live comfortably in Panama on our Social Security income?

Upcoming Conferences

The Only 2024 Fast Track Panama Conference

If your dream retirement involves stunning beaches… lush green mountains… a warm climate with no hurricanes… first-rate healthcare… incredible value for money (a couple can live well on $2,200 a month)… and the World’s #1 Retiree Discount Program…

Join our Panama experts and expats in February and discover why Panama could be your perfect paradise.

.png)